Applied Science Guest Post: Khufu Reign on The Renaissance of the Cultural Investor

Money, Art, and NFTs...

In the flattened novelty penny of time that has been pandemic life, it feels both infinitely long ago and just like yesterday that we were collectively riding BTC, ETH, and Doge to the moon while debating the relative merits and millionaire-making potential of three letters: NFT.

(I think it was February or March, but who can be sure! Time is an illusion!)

When we first bumped into this now-infamous abbreviation (meaning “non-fungible token,” if you managed to miss the hysteria), much was made of a newly accessible, direct, secure ability for creators to monetize their creations. You can imagine all the calls music managers received from frantic clients seeing early adopters like 3LAU and RAC making millions off of spinny GIFs and JPEGs—a numbing chorus of “can we do an NFT with Nifty Gateway? What about SuperRare?”

In March, I wrote about the state of independent music. I touched briefly on NFT’s, without getting too deep into longstanding perspectives and achievements of crypto communities for whom those letters represented a public distraction from the hard work being done to innovate financial systems for creators. As the dust has settled on historic Christie’s sales and the Nifty Gateway to another dimension seems to have temporarily closed, there’s room for a more level examination of NFT’s (which were and still are, essentially, digital agreements delineating ownership and value).

In today’s first ever Applied Science guest op-ed, manager Khufu Reign (We Make Music) takes a look at how NFT’s could reorient established fund-securing methods for art, while also opening up room for new investors and patrons (as well as a method for amortizing risk that some labels could find attractive).

Khufu’s piece was born out of internal debate on the age old question of the independent artist: How to get the money you need for the project you want to make. Khufu bandied about these ideas for how direct fan investment could alter the landscape of the music business in the coming months and years with colleague Brandon Hixon; the end result was a piece that not only plays with some of the philosophical tenets at the heart of the emergent creator economy, but also provides a concise map for putting principles into practice (particularly through the example of Khufu’s client 11 LIT3S).

The Renaissance of the Cultural Investor

by Khufu Reign

The Thesis

A new class of angel investors will focus on art instead of tech; these cultural investors will build communities, crowdfund artists, and supercharge talent discovery.

The Introduction

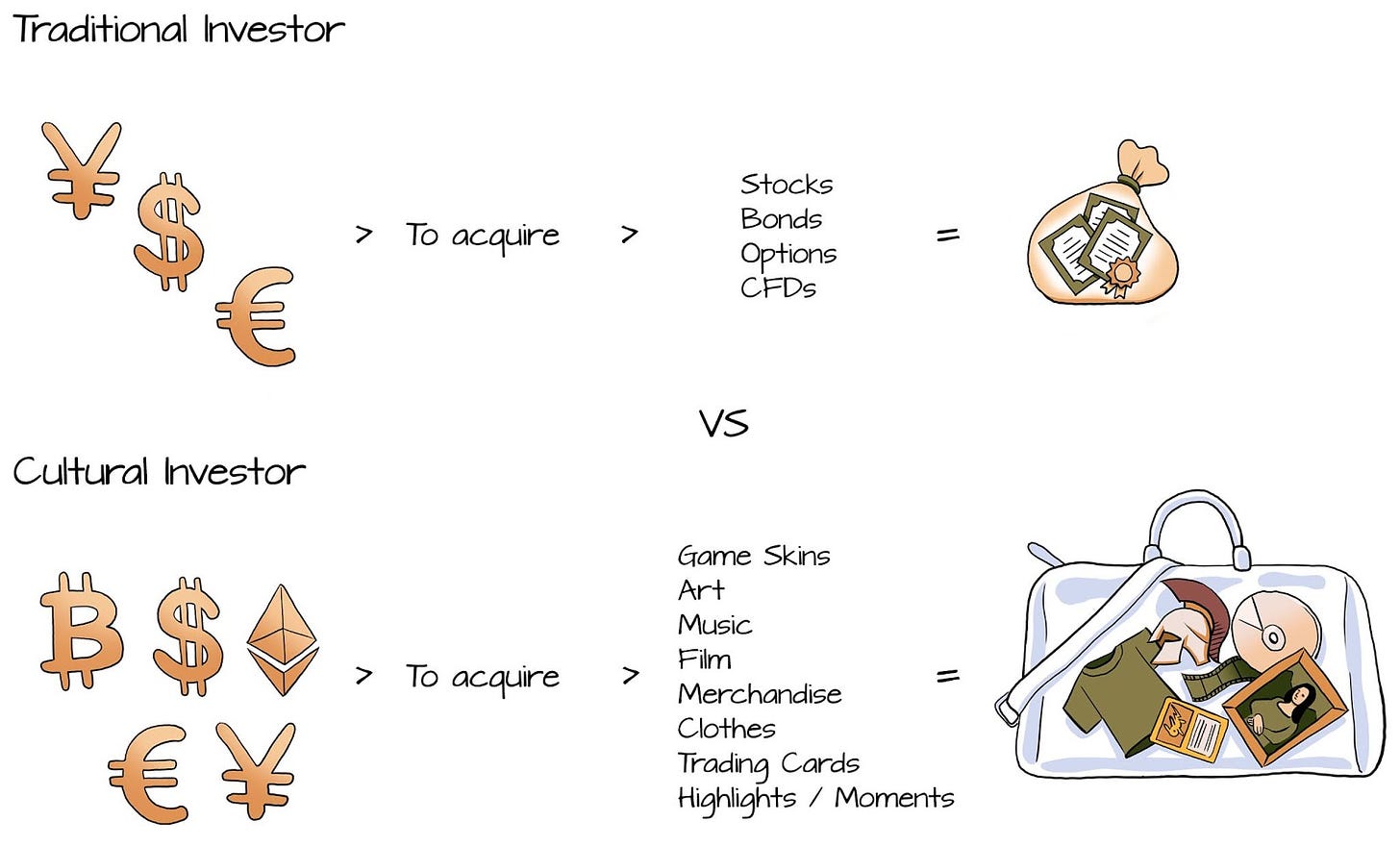

Culture and investing have become grossly overused terms in the last decade, so it seems cliche to bring them together when describing “the job of the future,” but the rise in popularity of cryptocurrency technology is giving way to what may be the dream gig of Gen Alpha. Cultural investors acquire art and other content that they deem culturally significant locally or globally. These acquisitions appreciate monetarily or hold other importance to the investor.

Instead of a portfolio of your favorite stocks and bonds, it’s a portfolio of your favorite art, clothes, game skins, (Top Shot) moments, etc…

This isn’t a new idea, it’s just been a logistical nightmare until now. Any creative industry where payments or royalties are tracked online can be a home for this new type of investor.

Let’s look at cultural investing in the music industry.

The Crowdfunding

Combining fractional ownership and art is an all time growth hack.

Two quick definitions.

Fractional Ownership: Your piece of the pie. Usually expressed as a percentage.

Ex: Mac owns 10% of the song.

Art: The conscious use of the imagination in the production of objects intended to be contemplated or appreciated as beautiful.

Imagine creating generational wealth because you knew about the next superstar when they barely had 1,000 fans.

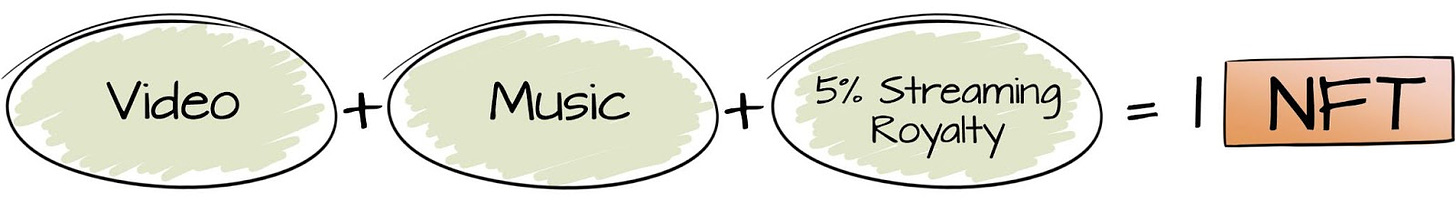

It’s 2022 and an independent artist is making noise in south Florida. A snippet drops of their next song and it goes viral. Using this attention to their advantage, they have their best friend cook up a short video using Unreal Engine and they sell the video and song as an NFT. They want each token holder to get 5% of the streaming royalty from the song’s release on DSPs (Apple, Tidal, Spotify, etc.).

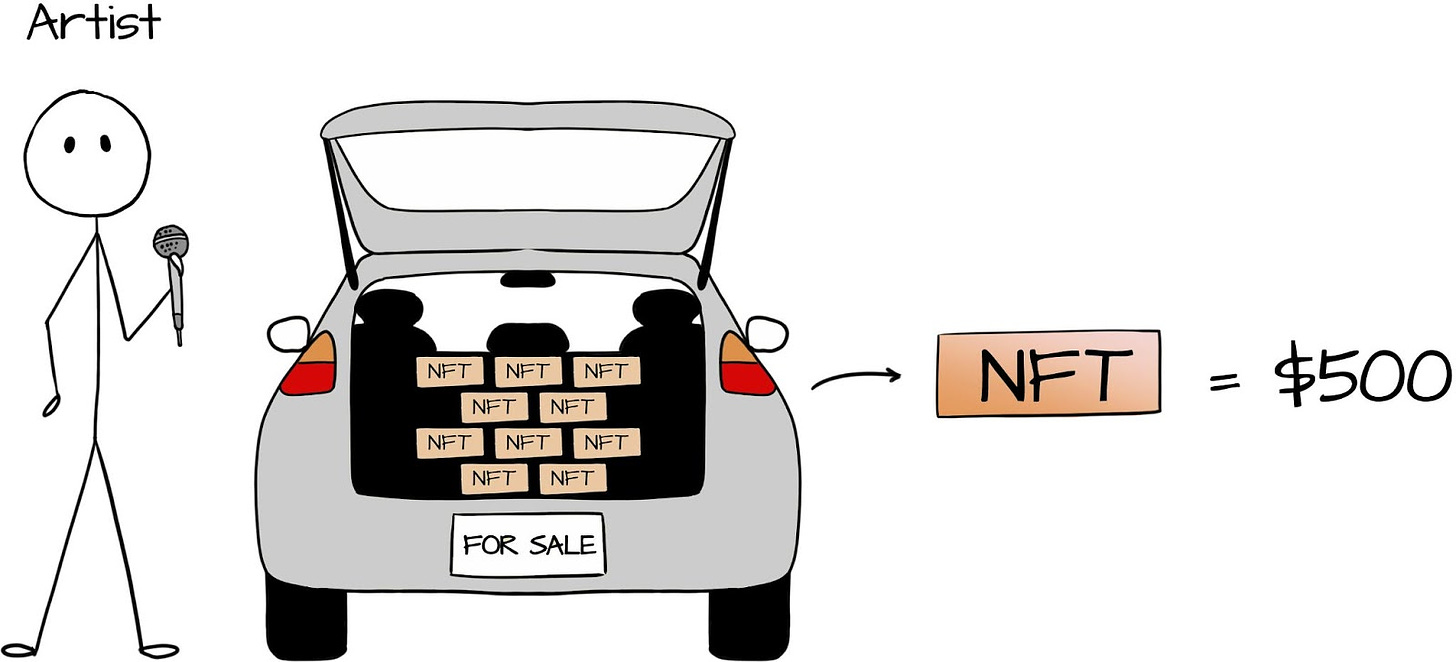

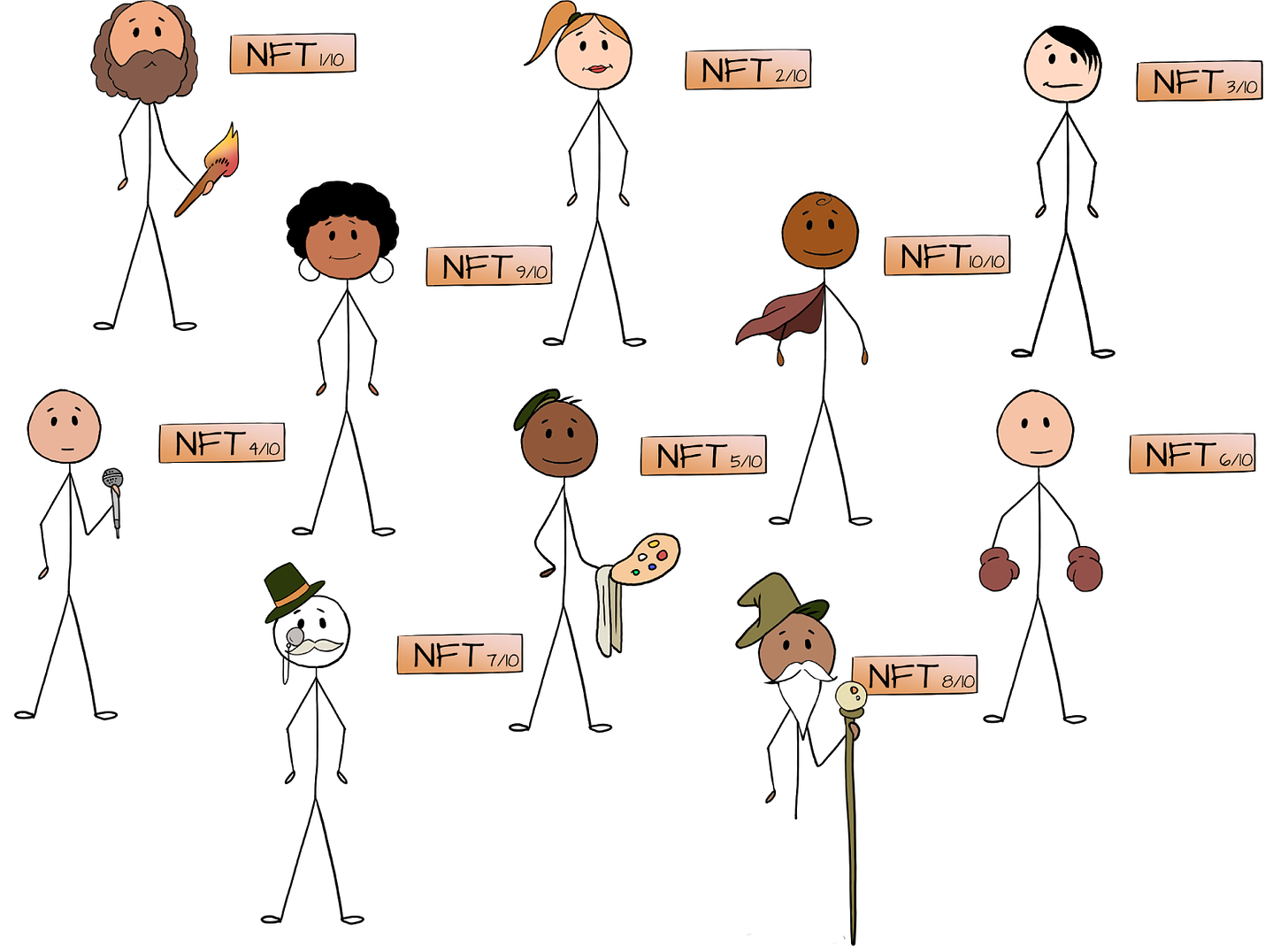

The artist creates 10 editions of the piece and charges $500 per token (edition).

The artist sells 10 tokens for $500 and a 5% streaming royalty. A total of $5,000 for 50% of the song.

Each cultural investor paid $500 and received an NFT.

With 5 million streams on the song, the artist makes roughly $30,000 ($5,000 from tokens and $25,000 from streaming [50% share of 5 million streams]).

Each investor would have $3,000 ($500 value of the NFT they own and $2,500 from streaming [5% share of 5 million streams]).

If the song is a hit and does 500 million streams? The artist makes over $2.5 million and each of those investors just turned $500 into over $250,000.

[NOTE: The streaming royalty is calculated using Apple Music’s payout scale and assumes the artist retains 100% of their streaming royalty rights. It also does not account for payouts to producers, songwriters, featured artists, or any other third party collaborators. There is even more money to be made on the secondary market for the NFT itself, for both artist and investor. Due to its speculative nature, the secondary market is impossible to predict. If the song does well and the artist gains more notoriety, it’s a reasonable assumption the NFT will also grow in value. These numbers assume the NFT does not go up or down in value.]

By adding cultural investors to the mix, record labels will be able to reallocate the risk they take on advances and marketing budgets.

It’s 2022 and Republic Records is negotiating a deal for their latest popstar. They auction off a portion of the streaming royalty for a future album. Using those funds, the artist now has the advance and marketing budget they desire and Republic utilizes company funds to improve infrastructure. The money saved from trading equity will allow labels to pay top dollar for talented staff and technology. Forward-thinking staff and cutting edge technology will enable labels to to deliver artist services at a scale never before possible in the industry. Savvy artists will continue to gravitate towards major label infrastructure as they recognize the importance of quality marketing and comprehensive music rollouts. There’s less risk in (good) staff than artists.

People know major labels have large budgets, but the economics scale with the type of artist. There are investors with enough money to afford the costs that the premier global talents incur. The financial return, status, and influence that comes with the art present an opportunity for a modern version of patronage that both supports creation and builds community.

The Community

If you come from nothing and have 50 people invest $10, you now have $500 to spend on making a video. You can give up 1% to each person and you now have a small budget and still own 50% of your song. These investors can play different roles from team members to advisors, promoters, and a bunch of ways I’m sure I haven’t thought of. You could build a large accessible community or a tight knit core of people with money who believe in you.

From social influencer to cultural investor, this gives a new definition to monetizing your platform. The inability to properly credit viral content has plagued many social media creators and hindered their ability to build off their success. Look at the case of black TikTokers going on “strike” for the value of their creation. Fed up with seeing their work replicated without the same vigor, quality or any type of acknowledgement has led to a halt in making a dance routine for Megan Thee Stallion’s new song “Thot Sh*t.” This doesn’t benefit the artist or the creators.

Minting a dance as an NFT before posting the video ensures a timestamped log of its birth. Now the creators have a digital certificate of ownership that can be associated with all potentially viral content. With their rights protected, creators can freely seek more artists to create dances for, furthering their own influence at the same time. Imagine the person who shows you your favorite dances makes money in conjunction with their viral success. There is a world of ancillary content that will spread artists’ music if the content creators are properly incentivized and invested in its spread.

There’s the financial gain, there’s fandom, and then there’s the flex. Instead of having the best aux, you have the best portfolio of hit songs you’ve invested in. It gives collectors and fans of smaller genres the ability to put their money where their eyes and ears are, while building their net worth. It’s a chance to show off your taste and your ability to predict culture.

This isn’t as foreign of a concept as you would think. “Tipping” has been common in eastern markets for over a decade. By adding a layer of fan benefits to their music, artists in Asia incentivize people to purchase multiple copies of an album (commonly referred to as tipping), as a sign of appreciation for the music. Cai Xukun sold one million copies of his digital album in less than two minutes. Rewards ranged from digital cosmetics to signed photo meet and greets for the person who purchased the most copies. This practice is so ingrained in the music ecosystem there that fans even team up to form “guilds.” These guilds compete to show who is the most supportive fan club. Cai’s number 1 fan guild accounted for 12.75% of his total album sales, with some members individually purchasing thousands of albums. Don’t discount rabid fans with deep pockets just wanting to collect and be a part of their favorite artists’ success.

These royalty bearing assets create long term social & fiscal wealth. These are investment vehicles that double as conduits to jumpstart underfunded artists’ careers and connect like-minded people.

The Talent Discovery

There is little incentive for fans to search for new music and artists. Cultural investors will bolster the effect of artist discovery and support at early stages because fans will be incentivized to find hidden gems. Right now, playlists and curators dominate what people hear on the streaming platforms. For all the people who say they were up on an artist early, there is now a financial motivation to discovery. Your relationships, group chats, and Discords will be used to try and discover the next Drake. This technology will create a wave of micro-A&Rs that will bring attention to more quality acts.

Artists upload over 60,000 songs a day to DSPs; this flood demands quality selection for the type of investor we’re envisioning. Picking out art that is visually striking, sonically pleasing & culturally relevant gives you three opportunities to make good on your investment. Having clear taste becomes the primary prerequisite to making money. Getting in early on the right artist means you could have some of their longest revenue generating pieces. Having ownership in the right art means you could help bring a hit to the public’s attention and never work again. This will drive creators to make the dopest art, as there will be more supportive eyes and ears than ever before. The quality of art that becomes popular is more reflective of the masses, than of a select few individual’s tastes. Large niche fanbases drive engagement more than ever before as artists build entire careers off their cult like followings.

The better your taste is, the less likely you’re investing in a depreciating asset.

The Logistics

In the words of Thanos, this is inevitable. I imagine the platform will be something like eBay plus Tumblr. A place where the NFTs can be displayed and auctioned, the rights managed and accounted for, and a social viewing / reposting / commenting element to it.

There is a possible solution right now, however it’s not completely “on-chain.”

How You Do It Now:

Create Video + Music + Story

The most crucial aspect of art is the art itself (meta, I know). The content must be well-crafted with a narrative that resonates with potential buyers. The music must also be rolled out and promoted well, this is very important to long term growth.

Choose Marketplace or Sell Directly

Nifty Gateway, SuperRare, Foundation, Origin, etc...

Token Redemption / Contact

Either you contact the purchasers of the NFT and verify they own it or have them contact you.

Release Music

Use DistroKid or Ditto for release (100% royalty distribution services) and add token buyers as collaborators to automate royalty payment.

If you have any questions on how to do this yourself (or ideas on how it could be improved) feel free to reach out. We’ll (We Make Music) be doing this process with 11 LIT3S’ next EP release and will share the resources / notes from the process (spreadsheet for tracking, royalty agreement, etc...).

How You (Might) Do It In The Future:

There will be a platform that will bundle the ideas above (and add some new ones) in a smooth manner that will make this as simple as signing up for an Instagram account. You will buy and sell the NFT & the royalty in one marketplace. The team at CreateSafe are starting to enable this new generation of rights management. They’re building a wallet that tracks art from creation, allowing creators to mint their art, sell directly to cultural investors or on a variety of exchanges, and understand musical monetization through their suite of simulators and forecasting tools. Artists can create, store, and monetize their music assets seamlessly.

These types of platform solutions may also be adopted in closed loop (permissioned) systems and done internally by larger artists or labels. Ease of use will be crucial to any platform in this space.

Some say this opens Pandora’s payola box. What happens when a DJ or executive with influence is secretly buying equity in an artist and over playing their music?

The simple answer is, it won’t matter. The best will prevail. With cultural investing you're incentivized to pick the most timeless and captivating pieces.

The Closing

There are at least three distinct bases of cultural investors.

Fan / Collector (Huge Audience): Who will buy and support because they love your content and/or love collecting art.

Flexer / Influencer (Rich Audience): Who will buy the art so other people can know they bought the art. The status they gain from curating or owning is worth it.

Savvy Investor (Huge + Rich Audience): Who understand the monetary value of what you make and think they have room to profit as well.

There are rarely ideas that prove good for the incumbents and the newcomers. That’s what makes the concept of cultural investments so universal. This is for the artist that loves world building and using multiple mediums to tell their stories. This is for the collector who lives to explore those worlds and experience the ideas. This is the start of something incredible. We’re barely scratching the surface of what the new digital age can be. An age where artists & the people that support them will have a more symbiotic relationship than ever before. The renaissance of the cultural investor is just beginning.

Hit us on email, DM or occasionally in Clubhouse to talk more.

Khufu Reign | khufu@wemakemusic.com | @khufu

Brandon Hixon | brandon@wemakemusic.com | @brandonvhixon